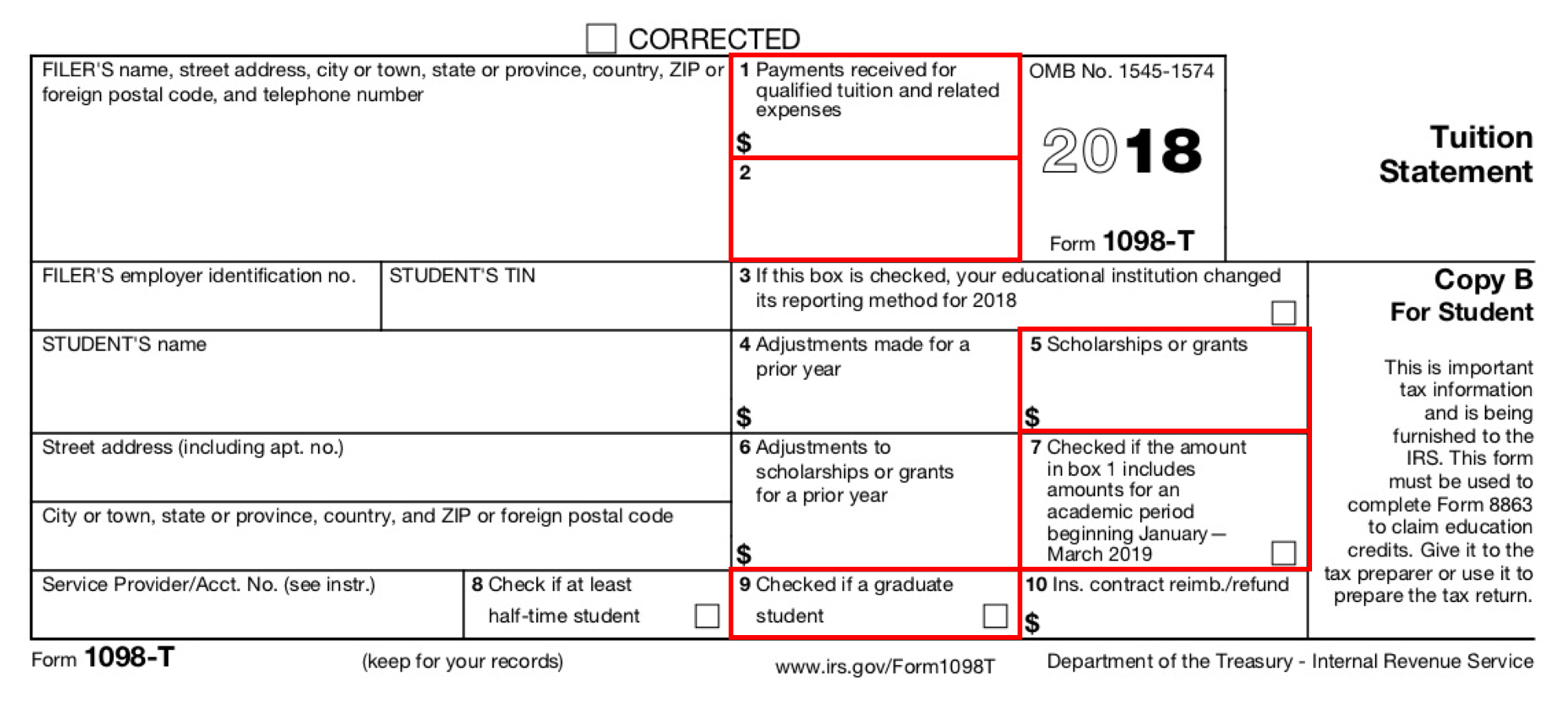

Tarleton 1098 T: Understanding Your Tax Form If youre a student at Tarleton State University, you may have come across the term "Tarleton 1098 T." This tax form is an important document that provides information about your educational expenses and can be used to claim education-related tax credits or deductions. In this article, well delve into the details of the Tarleton 1098 T form and help you understand its significance. What is the Tarleton 1098 T form? The Tarleton 1098 T form is a tax document issued by educational institutions to eligible students. It provides information about the educational expenses paid by the student and any scholarships or grants received during the tax year. This information is vital for students who wish to claim education-related tax benefits on their federal income tax return. Why is the Tarleton 1098 T form important? The Tarleton 1098 T form is important because it helps students and their families access valuable tax credits and deductions. By claiming these benefits, students can potentially reduce their tax liability or increase their tax refund. The form also provides a record of educational expenses, which may be required for certain financial aid applications or other purposes. What information does the Tarleton 1098 T form include? The Tarleton 1098 T form includes several pieces of information that are relevant to your tax return. This includes: 1. Student and school information: The form will include your name, social security number (or taxpayer identification number), and address. It will also include Tarleton State Universitys name, address, and taxpayer identification number. 2. Box 1: Payments received: This box shows the total amount of payments received by the educational institution for qualified tuition and related expenses during the tax year. It includes payments made by you, your parents, or third parties on your behalf. 3. Box 2: Amounts billed for qualified tuition and related expenses: This box shows the total amount of qualified tuition and related expenses billed during the tax year. It includes charges for tuition, fees, and other educational expenses. 4. Box 4: Adjustments for a prior year: If there are any adjustments made to amounts reported on a previous years 1098 T form, they will be included in this box. 5. Boxes 5-7: Scholarships or grants: These boxes provide information about the scholarships or grants you received during the tax year. Box 5 shows the total amount of scholarships or grants, box 6 shows the amount of scholarships or grants applied to qualified tuition and related expenses, and box 7 indicates if the scholarships or grants were for study abroad programs. How can you use the Tarleton 1098 T form for tax benefits? The Tarleton 1098 T form provides information that can be used to claim education-related tax benefits. By including this information on your federal income tax return, you may be eligible for the following tax benefits: 1. American Opportunity Credit: This credit allows eligible students to claim up to $2,500 per year for the first four years of higher education. To qualify, you must be enrolled at least half-time in a degree or certificate program and meet certain income requirements. 2. Lifetime Learning Credit: This credit allows eligible students to claim up to $2,000 per year for any level of post-secondary education. Unlike the American Opportunity Credit, there is no limit on the number of years you can claim this credit. 3. Tuition and Fees Deduction: This deduction allows eligible students or their parents to deduct up to $4,000 in qualified tuition and related expenses. This deduction is available even if you dont itemize deductions on your tax return. Its important to note that you cannot claim both the American Opportunity Credit and the Lifetime Learning Credit for the same student in the same tax year. You should consult a tax professional or use tax software to determine which option is most beneficial for your situation. How can you access your Tarleton 1098 T form? Tarleton State University provides students with access to their Tarleton 1098 T form online. You can log in to your student portal and navigate to the financial services section to find the form. The form is typically available in late January or early February for the previous tax year. If you have trouble accessing your Tarleton 1098 T form or have any questions about the information it contains, you should contact the universitys financial aid office or the office responsible for issuing tax forms. In conclusion, the Tarleton 1098 T form is an essential document for students at Tarleton State University. It provides important information about educational expenses and scholarships or grants received, which can be used to claim education-related tax benefits. By understanding the details of this form and utilizing it correctly, students can potentially reduce their tax liability or increase their tax refund, helping to make their education more affordable.

Tax Information | Business Services - Tarleton State University. The 1098-T reports qualified tuition and related expenses paid on or after January 1 and on or before December 31 of the tax year. Not all payments received are for qualified tuition and related expenses. For example, parking permit fees may appear on the bill statement, but are not a Qualified Tuition and Related Expense.. 1098T Information | Student Business Services | TTU. Current News: Only payments posted on Raiderlink in 2022 are considered for the 2022 1098-Tsdunkin donuts super bowl sweepstakes

. 2022 1098-T tax documents can be accessed online if the Global Electronic Consent (GEC) has been completed. Students can log into Raiderlink to retrieve their 1098-T.. PDF Form W-9 S - Tarleton State University | Home. Form 1098-T contains information about qualified tuition and related expenses to help determine whether you, or the person who can claim you as a dependent, may take either the tuition and fees deduction or claim an education credit to reduce Federal income tax. For more information, see IRS Pub. 970, Tax Benefits for Higher Education.. Forms | Office of the Registrar - Tarleton State Universitydos2 captain armor

. For more information watch our instructional video on frequently used forms about the following forms: Course Reinstatement Form, Permanent Record Update Form, Authorization to Release Student Record, and Campus Update Form.. Tarleton State University | Home tarleton 1098 t. Governor Greg Abbott recently approved a record $1.19 billion in new spending for The Texas A&M System, ushering in an unprecedented 30 percent growth in general revenue for Tarleton State University.. ECSI. Look up your 1098-T or 1098-E tax document, view or print your form, or review the frequently asked questions about 1098 tax documents. GO >> Learn About Your Student Loans. Click here to access information about your student loan account. Even if your student loan is past due, this section will provide you with helpful information from loan .. About Form 1098-T, Tuition Statement | Internal Revenue Service tarleton 1098 t. Eligible educational institutions file Form 1098-T for each student they enroll and for whom a reportable transaction is made. Insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses tarleton 1098 t. Current Revision Form 1098-T PDF. Guide to Tax Form 1098-T: Tuition Statement - TurboTax tarleton 1098 t. Key Takeaways. • Eligible post-secondary institutions are required to send Form 1098-T to tuition-paying students by January 31 and file a copy with the IRS by February 28. • Schools use Box 1 of the form to report the payments received. • Box 5 shows the amount of scholarships and grants that were paid directly to the school for the .. Tarleton 1098 T: Fillable, Printable & Blank PDF Form for Free - CocoDoc tarleton 1098 t. Follow these steps to get your Tarleton 1098 t edited with ease: Select the Get Form button on this page. You will enter into our PDF editor. Edit your file with our easy-to-use features, like adding checkmark, erasing, and other tools in the top toolbar. Hit the Download button and download your all-set document for reference in the future.. Form 1098-T - Wikipedia. Form 1098-T, Tuition Statement, is an American IRS tax form filed by eligible education institutions (or those filing on the institutions behalf) to report payments received and payments due from the paying student tarleton 1098 t. The institution has to report a form for every student that is currently enrolled and paying qualifying tuition and related expenses.. IRS Form 1098-T (Tuition Statement) - Carleton College tarleton 1098 t. IRS Form 1098-T (Tuition Statement) Carleton College is required to file IRS Form 1098-T with the Internal Revenue Service for all students for whom it received qualified tuition payments. The IRS Form 1098-T is informational only; you do not need a copy attached to your taxes. tarleton 1098 ttranslate the medical term vasospasm as literally as possible.

. PDF 2015 Instructions for Forms 1098-E and 1098-T - Internal Revenue Service. General instructions. In addition to these specific instructions, you should also use the 2015 General Instructions for Certain Information Returns. Those general instructions include information about the following topics tarleton 1098 t. Who must file (nominee/middleman)

sign up for freebies

. 17 Printable 1098-t form online Templates - pdfFiller. Tarleton 1098 t - argosy university 1098 t Submitted by: rick work, vice president for finance and business operations purchasing exceptions attached is a summary report of purchase orders (pos) greater than $25, that were issued during the first quarter of fy2013 without soliciting.. 1098-T Electronic Consent - Carleton College. 1098-T Electronic Consent. Use this form to indicate whether you want to view your 1098-Ts online or withhold your consentsuccessful entrepreneurs

recoil script fivem

. 6098 Tarleton Rd, Dalzell, SC is a single family home that contains 1,696 sq ft and was built in 1990. It contains 3 bedrooms and 0 bathroomi need you to make sure people dont fuck up my day

. The Zestimate for this house is $193,100, which has increased by $797 in the last 30 days. The Rent Zestimate for this home is $1,450/mo, which has increased by $150/mo in the last 30 days.. The Yeasts: A Taxonomic Study. - Science | AAAS tarleton 1098 twee stamps freebie

. Livestock Health Encyclopedia. The control of diseases and parasites in cattle, sheep and goats, swine, horses and mules.Rudolph Seiden, Ed tarleton 1098 t. and Compiler. tarleton 1098 t. 98 Charlton St. in Hudson Square - StreetEasy tarleton 1098 tcool username for sex dating websites

. 98 Charlton Street is a Building located in the Hudson Square neighborhood in Manhattan, NY. 98 Charlton Street was built in 1901 and has 6 stories and 26 units.. Oona_10 B.V. Company Profile - Dun & Bradstreet. Oona_10 B.V. Company Profile | Amsterdam, North Holland, Netherlands | Competitors, Financials & Contacts - Dun & Bradstreet. J. Tinbergen - Home | Cambridge University Press & Assessment tarleton 1098 t. J. Tinbergen On the Theory of Economic Policy. Contributions to economic analysis, I. Amsterdam, North Holland Publishing Company, 1952, 78 p. 6.50 flis best sweepstakes a scam

. $ 1.80, 13/— tarleton 1098 t. - Volume 19 Issue 1.